Perilfinder for Lending

Assessing property risk at the point of origination – today and into the future

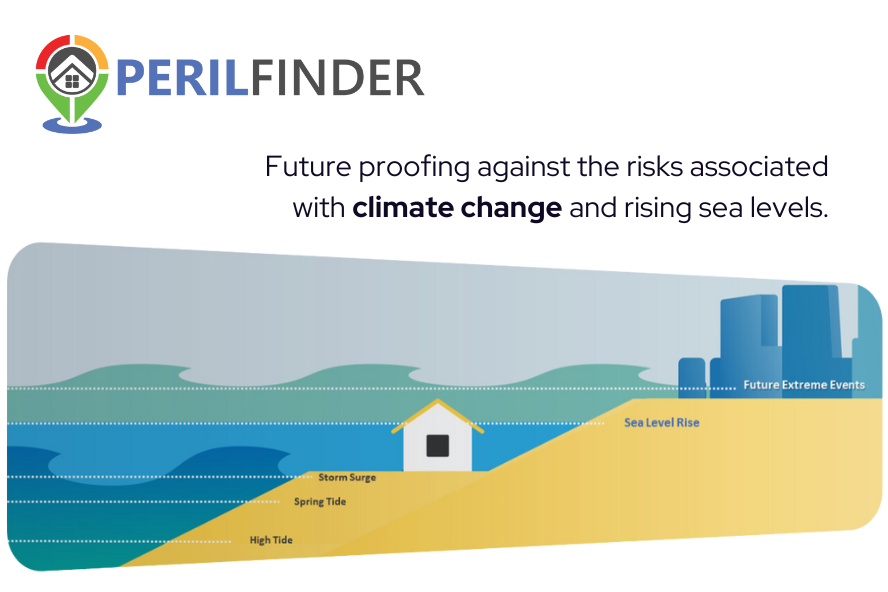

What environmental risks will affect mortgage security over the loan term? How will climate change alter a property’s viability in 20 years time? How does a property contribute to our scope 3 greenhouse gas emissions through its energy usage?

Perilfinder™ is the complete address-level risk assessment, exposure management and reporting platform. Empowering lenders and mortgage advisors to appraise current property-level risk at the point of origination. Perilfinder™ also estimates the assets long-term risk exposure in terms of climate change and its GHG emissions.

Perilfinder™ is the complete address-level risk assessment, exposure management and reporting platform. Empowering lenders and mortgage advisors to appraise current property-level risk at the point of origination. Perilfinder™ also estimates the assets long-term risk exposure in terms of climate change and its GHG emissions.

Benefits For Lending

Incorporating dashboard reporting, mapping, and RAG scoring , Perilfinder™ for Lending offers a scaleable and customisable property risk solution for mortgages and commercial loans, enabling climate change risk assessment in your approval processes.

Evaluate Your Risk Exposure

Perilfinder™ provides you with the specialist data and tools to evaluate risk exposure associated with your property portfolio, allowing you to write more business that aligns to your net-zero and climate change objectives.

Speed Up Decision Making Process

Calculating risk scores based on multiple risk-data feeds and your business rules, Perilfinder™ allows you to make quick lending decisions at the point of loan origination. So, you can provide, faster quotations & better customer service.

Enterprise Grade with Rapid Onboarding

Perilfinder™ is an Enterprise-grade platform used by leading banks. Onboarding is quick, and the software can be customised to your business requirements – from appetite through to workflows.

Increase Profitability

Perilfinder™ enables you to assess your risk exposure to remain compliant with your risk appetite. Through improved accumulations management and reporting, and through better risk reporting Perilfinder™ helps reduce your lending loss ratio and identify green-loan opportunities.

Multiple Peril Models - All in One Platform

With built-in property level geocoding and building footprint mapping, along with flood, crime, subsidence, and climate change models, Perilfinder™ shows you address-level risks today and into the future.

SaaS Pricing

Flexible and transparent SaaS pricing based on the volumes of records you need to assess. Banded pricing allows for lower cost of ownership for smaller operators, yet gives you the flexibility to scale as required. Perilfinder™ offers real value - whatever your business size.

Benefits For Lending

Incorporating dashboard reporting, mapping, and RAG scoring , Perilfinder™ for Lending offers a scaleable and customisable property risk solution for mortgages and commercial loans, enabling climate change risk assessment in your approval processes.

Evaluate Your Risk Exposure

Perilfinder™ provides you with the specialist data and tools to evaluate risk exposure associated with your property portfolio, allowing you to write more business that aligns to your net-zero and climate change objectives.

Speed up Decision Making Process

Calculating risk scores based on multiple risk-data feeds and your business rules, Perilfinder™ allows you to make quick lending decisions at the point of loan origination. So, you can provide, faster quotations & better customer service.

Enterprise Grade with Rapid Onboarding

Perilfinder™ is an Enterprise-grade platform used by leading banks. Onboarding is quick, and the software can be customised to your business requirements – from appetite through to workflows.

Increase Profitability

Perilfinder™ enables you to assess your risk exposure to remain compliant with your risk appetite. Through improved accumulations management and reporting, and through better risk reporting Perilfinder™ helps reduce your lending loss ratio and identify green-loan opportunities.

Multiple Peril Models - All in One Platform

With built-in property level geocoding and building footprint mapping, along with flood, crime, subsidence, and climate change models, Perilfinder™ shows you address-level risks today and into the future.

SaaS Pricing

Flexible and transparent SaaS pricing based on the volumes of records you need to assess. Banded pricing allows for lower cost of ownership for smaller operators, yet gives you the flexibility to scale as required. Perilfinder™ offers real value - whatever your business size.

Product Features

Perilfinder’s applications and APIs deliver verified and cleansed property-level data and risk models in sub-second time.

Access to over 35M property details for UK & Ireland.

Premium roof-top level geocoding.

Cloud native customisable solution to meet your business requirements.

Superb map visualisation.

Intuitive risk and accumulation scoring.

Property Level Data on Climate Change Risk.

CO2 and Energy Rating Models at Property Level.

Find out how Gamma can help your organisation today.

Talk to our team and discover how our solutions can revolutionise your risk assessment process.