Gamma Risk once again participated in the MGAA Annual Conference (MGAA 2025), a premier event for Managing General Agents (MGAs), insurers, and solution providers shaping the future of the insurance market.

This year’s conference brought together industry leaders to explore emerging trends, discuss regulatory developments, and showcase cutting-edge technologies transforming the underwriting and risk assessment landscape.

Highlights

One of the key themes of MGAA 2025 was the growing importance of advanced data and technology in empowering MGAs. Attendees explored how the latest insurtech solutions are enhancing underwriting efficiency, enabling real-time property intelligence, and supporting faster, more accurate decision-making.

Live sessions showcased the benefits of leveraging high-quality data and analytics to optimise portfolios and reduce risk exposure in an increasingly competitive market.

Another major focus of the conference was the ESG imperative and regulatory change. Delegates engaged in discussions on evolving CSRD and ESG reporting requirements, particularly the challenges of Scope 3 property emissions and double materiality.

These conversations underscored the necessity of climate-focused insights and next-generation technologies that deliver more precise insights and drive smarter decisions, supporting MGAs in achieving both compliance and sustainable growth.

The event also reinforced the value of strong MGA–insurer partnerships in achieving growth. Keynote panels examined how collaboration is essential for navigating market volatility and addressing emerging climate-driven risks.

Speakers emphasised that data-driven strategies and tailored risk products are instrumental in helping MGAs strengthen their market position and unlock new opportunities.

Gamma Risk at MGAA 2025

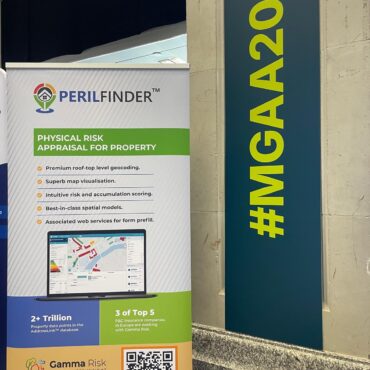

Throughout the conference, Gamma Risk showcased our solutions, including Perilfinder™, AddressLink™, and EPCWOW. These solutions equip MGAs to achieve frictionless underwriting, regulatory readiness, and actionable portfolio insights.

This year, our presence also highlighted our integration with KatRisk, which enables the delivery of more precise insights and next-generation technologies that drive smarter decisions, while reinforcing the expansion of Gamma Risk’s footprint in the UK MGA market.

Our Chief Operating Officer, Richard Garry, shared his perspective on the event:

Richard Garry

COO at Gamma Risk

As MGAs continue to face intensifying regulatory requirements, shifting market conditions, and climate-related challenges, Gamma Risk remains committed to delivering innovative, scalable solutions that empower underwriting intelligence and sustainable growth across the sector.

For those who want to continue the conversation or schedule a demo of our solutions, visit this page.